How Proprietary Forex Trading Firms Can Help You Scale Your Trading

The world of forex trading is exciting and filled with opportunities, but for many aspiring traders, breaking into the market can feel like an overwhelming challenge. One of the biggest hurdles is gaining access to substantial capital to trade with, while also managing the risks that come with it. Without the necessary resources and expertise, many traders find it hard to scale their strategies and succeed. This is where proprietary (prop) forex trading firms step in, offering an invaluable chance for traders to accelerate their careers, leverage larger capital, and develop their skills. In this blog, we will explore how proprietary trading firms can be the key to scaling your trading career and maximizing your potential.

1. Access to Capital: Trading Beyond Your Personal Savings

One of the most significant advantages of trading with a proprietary forex firm is the access to larger amounts of capital. For an individual trader, using personal savings to trade can be risky, especially when starting with a limited amount of funds. Proprietary trading firms, however, provide traders with the opportunity to trade with their capital. These firms offer traders the chance to manage substantial amounts of money without risking their own savings.

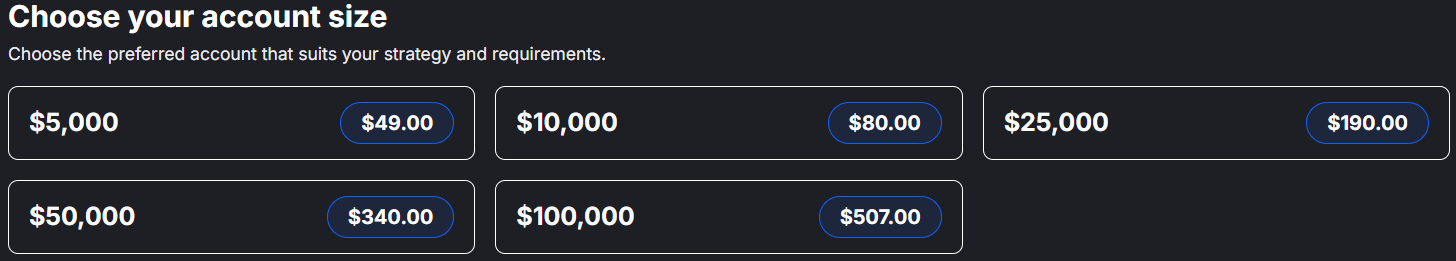

This access to more significant capital enables traders to take larger positions and potentially earn higher profits compared to what they could achieve with their personal accounts. For example, if a trader joins Monevis and can handle a $100,000 funded account but only has $10,000 to start, we allow them to trade at the $100,000 level, increasing the trader’s ability to scale up their returns. Essentially, traders are using the Monevis’s capital to trade, and in return, they share a percentage of the profits generated. This can be incredibly lucrative, as trading with more capital allows for more flexibility and greater earning potential even for the traders wanting smaller capital all the way from 5K USD to 100K USD.

2. Risk Management and Support: Protection for Traders

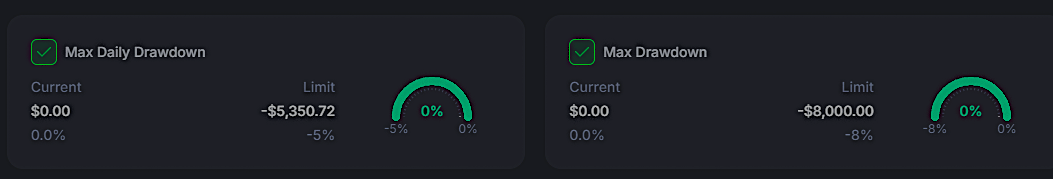

Trading in the forex market can be highly volatile, and without a proper risk management strategy, losses can mount quickly. Fortunately, proprietary trading firms usually offer robust risk management frameworks that help mitigate the risks traders face. Most prop firms provide detailed guidelines on position sizing, leverage, and loss limits, ensuring that traders stay within manageable boundaries.

By following these guidelines at Monevis, traders can protect themselves from the severe consequences of large losses. We have a vested interest in the success of their traders, so they usually set these risk limits to ensure both parties, Monevis & the trader can operate sustainably in the long term. Additionally, maintaining good discipline is key to success in the forex market. Traders who adhere to their strategies, avoid emotional decisions, and stick to established risk management rules are better positioned for consistent success. This combination of structured risk management and disciplined trading practices allows traders to grow their skills without taking on excessive risk, making it easier for us to give bigger capital to reward consistency.

3. Cutting-Edge Tools and Technology: Enhancing Performance

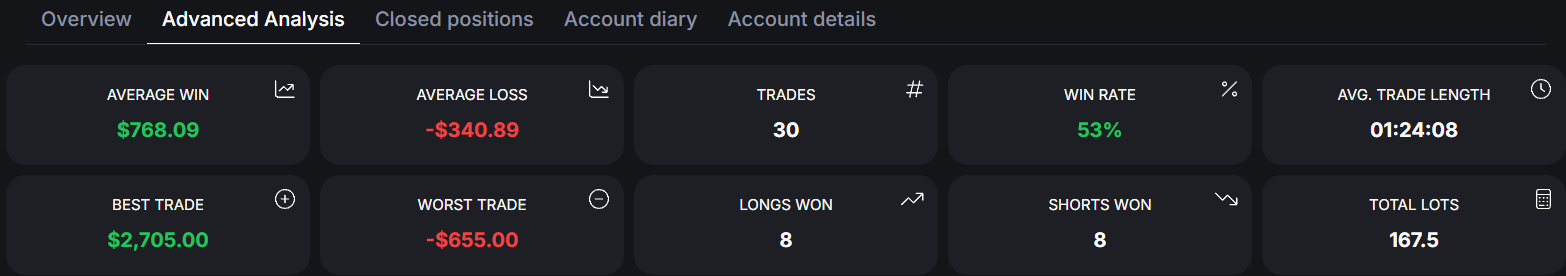

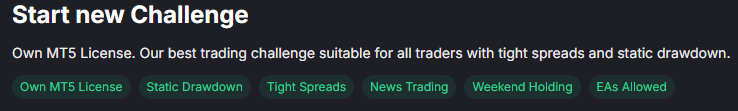

The forex market is one of the most competitive financial markets in the world, with hundreds of thousands of traders trying to gain an edge. To stay competitive, having access to cutting-edge tools and technology is essential. Fortunately, proprietary trading firms often provide their traders with access to advanced trading platforms, sophisticated analytics, and even risk assessment tools.

These tools we provide enable traders to analyze the market with greater accuracy, execute trades more efficiently, and make data-driven decisions. Whether it’s using advanced charting software, accessing real-time market data, the technology offered by prop firms enhances traders’ abilities to operate at a higher level. By having access to these resources, traders can be more confident in their decisions and capitalize on market opportunities that they might otherwise miss.

4. Performance-Based Incentives: Motivating Success

Another compelling reason to work with a proprietary trading firm is the performance-based compensation model. In this model, traders are rewarded based on the profits they generate, and their ability to scale with the company. As traders demonstrate consistent success, firms often increase the capital available for them to trade with. This incentivizes traders to continue improving their strategies and maintaining strong performance, knowing that the firm will scale their trading capital in line with their results. This structure aligns the interests of both the trader and the firm, as both parties benefit from the trader’s success and the growth of their trading career, knowing that their success directly translates into financial rewards.

5. Flexibility and Independence: Trading on Your Terms

While proprietary trading firms provide structure and support, they also offer a degree of independence. Many prop firms allow traders to trade with flexibility, giving them the freedom to develop their trading strategies and take positions at their discretion. As long as they adhere to the firm’s risk management rules and performance expectations, traders have a level of autonomy that allows them to personalize their trading approach.

This combination of structure and freedom makes proprietary trading firms an attractive option for many traders. With Monevis they can benefit from the support and resources provided by the firm but still maintain the flexibility to apply their unique trading style and approach.

Conclusion: Unlocking Your Trading Potential

Proprietary forex trading firms offer an exciting and unique opportunity for traders who want to scale their careers. Monevis funding provides access to significant capital, a structured risk management system, professional training, advanced tools, and performance-based incentives, Monevis will help traders not only grow their portfolios but also improve their overall trading skills. Whether you’re a seasoned trader looking to scale your operations or a newcomer hoping to fast-track your success, partnering with a prop trading firm could be the key to unlocking your trading potential and accelerating your career in the dynamic world of forex trading.

SCALE YOUR TRADING CAPITAL WITH MONEVIS

Monevis Blog